Dragon Capital Acts as Joint Lead Manager in MHP’s US$450 Million Eurobond Issue

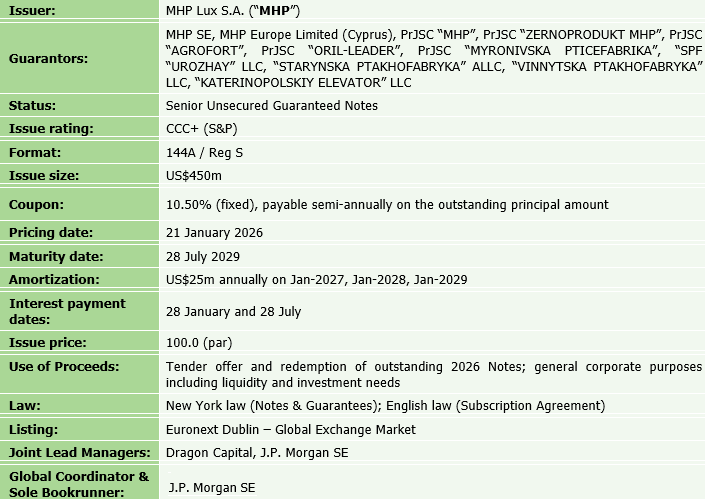

The notes were placed with a 10.50% coupon and maturity in July 2029. MHP is an international vertically integrated agri-food group with Ukrainian roots and one of the largest poultry producers in Europe.

The transaction marked the first corporate Eurobond issuance from Ukraine on international debt capital markets since the start of the full-scale invasion in 2022.

The issuance attracted exceptionally strong investor demand with the orderbook peaking at over US$2.4 billion, more than 5 times oversubscription. Strong momentum and solid secondary market performance enabled MHP to execute an additional US$100 million tap at a premium to par (104%), increasing the total issue size to US$550 million.

The proceeds from the offering are being used to finance the tender offer and redemption of MHP’s US$550 million 6.95% Notes due in April 2026, extending MHP’s maturity profile and strengthening its liquidity position.

For Dragon Capital, participation in this placement marked an important step in restoring access to international debt capital markets for Ukrainian corporate issuers.

Key transaction parameters: